Part time salary tax calculator

Input the date of you last pay rise when your current pay was set and find out where your current salary has changed in real terms relative inflation. It will tell you how much money you will receive weekly fortnightly monthly and yearly in your payslip.

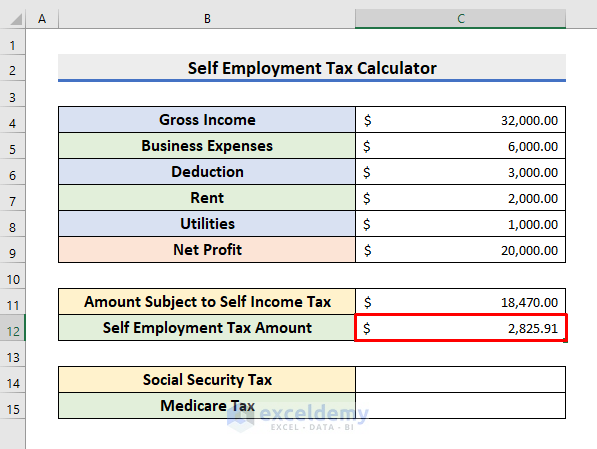

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

If you are changing to part-time work or are considering a job where the salary is worked out pro-rata use the pro-rata Salary Calculator to see how your take-home pay will be affected.

. These include Roth 401k contributions. Thats as true for part-time work as for salary work. For example you may be paid an annual salary of 25000 pro rata - but you only actually work for part time in which case youll be paid a proportion of the 25000 based on how much of the.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. Your average tax rate is 165 and your marginal tax rate is 297. Date of last pay rise.

The payment for the earned income credit or noncustodial parent earned income credit is 25 of the amount of the credit you received for 2021. Simply enter your salary or hourly wage and let our calculator do the rest. Some deductions from your paycheck are made post-tax.

Use New Zealands best income tax calculator to work out how much money you will take home after taxes. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. Pro-Rata Furlough Tax Calculator.

The money for these accounts comes out of your wages after income tax has already been applied. 5 hours double. You can also enter a percentage of your full salary if your pay is being reduced eg.

So normal part-timers dont need to pay income tax if annual income is less than 1030000 yen while 1300000 yen for part-time working students. Currently there are three tax brackets in Kansas that depend on your income level. Average salary for Part Time jobs in calculator.

All Services Backed by Tax Guarantee. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Income Tax Rate ranges from 5 to 45 increasing with taxable gross income. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

For example if you did 10 extra hours each month at time-and-a-half you would enter 10 15. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings. Discover Helpful Information And Resources On Taxes From AARP.

Use this calculator to see how inflation will change your pay in real terms. This marginal tax rate means that your immediate additional income will be taxed at this rate. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Related Take Home Pay Calculator Income Tax Calculator. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Annual Pay 4893300 Taxable Income 6000000 Superannuation 630000 Tax 1106700 Income tax 996700 LITO Low Income Tax Offset -10000 Medicare Single no dependants.

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. Your average tax rate is 220 and your marginal tax rate is 353. A salary or wage is the payment from an employer to a worker for the time and works contributed.

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. Enter the number of hours and the rate at which you will get paid. That means that your net pay will be 45925 per year or 3827 per month.

The PAYE Calculator will auto calculate your saved Main gross salary. This marginal tax rate means that your immediate additional income will be taxed at this rate. This is paid to the prefecture and municipality where the taxpayer is living.

If you make 55000 a year living in the region of New York USA you will be taxed 11959. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Since Jan 2022 your salary has effectively fallen by.

The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. If youre single married and filing separately or a head of a household you will be taxed at 310 on the first 15000 of taxable income at 525 on the next 15000 and at 570 on all income above 30000.

You can change the calculation by saving a new Main income. The unadjusted results ignore the holidays and paid vacation days. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

That means that your net pay will be 43041 per year or 3587 per month. Calculate Annual leave entitlement Every NHS worker whether part-time or full- time is entitled to paid annual leave. The percentage depends on your income.

Flexible or part-time hours move the slider down from five days to the new number of days you plan to work this will calculate your reduced salary holiday entitlement and pension. Your average tax rate is 217 and your marginal tax rate is 360. That means that your net pay will be 40568 per year or 3381 per month.

Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay. Only one payment your check is. To stop the auto-calculation you will need to delete your saved PAYE Calculator data from your User Profile settings.

Input salary benefits provide your full-time weekly monthly or annual salary holiday entitlement and the percentage you contribute to your pension. This marginal tax rate means that your immediate additional income will be taxed at this rate. Have full transparency on how much of your paycheque goes.

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

2021 2022 Income Tax Calculator Canada Wowa Ca

Salary To Hourly Salary Converter Salary Hour Calculators

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Avanti Gross Salary Calculator

Income Tax Formula Excel University

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Avanti Income Tax Calculator

![]()

Canada Income Tax Calculator Your After Tax Salary In 2022

Income Tax Formula Excel University

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Pro Rata Salary Calculator Uk Tax Calculators

Pin On Things I Like

Ontario Income Tax Calculator Wowa Ca

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Salary Formula Calculate Salary Calculator Excel Template